The Great Depression Part 2.

To understand why the Great Depression happened we should take a quick look at what the prevailing philosophy of economics was at the time (Classical Economics). The main point of Classical economics is that the supply curve of an economy always tends toward full employment of labor and capital. The money supply and thus aggregate demand only control the price level (inflation) and can not change the output level of the economy. And yes many theories also believe as such in the long-run but see that the transition can be long especially considering sticky wages (Sticky).

Thus since the government had little control over the economy (monetary or fiscal controls) it was best to let the self-adjusting tendencies to correct the economy than have destabilizing government policies.

Before progressing to Keynes, let me address the monetarist theories. The monetarists took some of the same philosophies of classicalist but expanded and showed that a stable money supply is best for long term growth and stability. The stable money supply was defined as constant growth rate for the money stock (M1, M2, M3) no matter what shocks to the system there may be. So set it on auto pilot and watch the economy grow.

Monetarist propositions are:

1. The supply of money is the dominant influence on nominal income.

2. In the long run, the influence of money is primarily on the price level and other nominal magnitudes. In the long run, real variables, such as real output and employment, are determined by real, not monetary factors.

3. In the short run, the supply of money does influence real variables. Money is the dominant factor causing cyclical movements in output and employment.

4. The private sector of the economy is inherently stable. Instability in the economy is primarily the result of government policies.

Even though at first the Federal Reserve tried to add liquidity to the banking sector in the end they let the money supply decline. This was shown in the last post and link and the fact M1 declined by 26.5% and M2 by 33.3% between the dates 1929 to 1933.

Without getting into the minutiae of Keynes let me explain some basic theory. First we need to start with identities of what factors drive the economy.

Y=C+I(r)+G

S+T=I(r)+G

So the GDP(Y) is made up of Consumption, realized Investments, and Government spending.

Savings plus Taxes equal realized Investments and Government spending.

In the classical and the monetarist versions, T=G since no deficit or surplus of the government budget. Then S=I(r) tends toward equilibrium in the long run. A shortage of money for lending causes the interest rates to rise until an increase in savings to correspond for the increases in Investment spending.

But to repeat Keynes:

this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.So now one problem with S=I is that if interest rates are too low then a rise in interest rates will not change the marginal propensity to save, which is also referred to as Liquidity Trap.

So what does this all mean? What caused the Great Depression?

1. First and foremost was the drop in money stock. Which actually led to deflation, causing money to increase in value relative to tangible assets or products? Why put into savings when the rates were too low?

2. No FDIC to insure deposits. And the central bank not lending liquidity when the system needed it most, thus it caused a loss of confidence in the banking system as a whole. As was shown in bank runs and the number of banks that became insolvent and thus bankruptcy was the only choice.

3. In a simplistic way Savings did not equal realized Investments. Expectations of the future based on what had happened before dictated that consumption was low and savings was mostly in cash. Banks that had excess reserves did not lend out as much because of fear of run on banks and liquidity problems. And lastly even with low interest rates businesses failed to increase investments based on expectations. Since there was some unintended investments (increased levels of inventory at first), latter periods showed less willingness to increase investments.

4. Fiscal policies of the US government exasperated the problem. Increasing the marginal tax rates during the depression:

Marginal income tax rates were raised from 1.5% to 4% at the low end and from 25% to 63% at the top of the scale. A huge tax increase by any measure.

5. So going back to our identities. If S+T=I(r)+G and S does not equal I(r), then the government could increase spending and/or reduce taxes. And this would be done by either borrowing from the public, inflows of capital, or from the Federal Reserve Board monetarizing the debt. Luckily we have many such safeguards in place through unemployment insurance and marginal tax rates.

6. Not that I agree with this statement:

”The over-stimulated economic euphoria of the 1920s.”

but wanted to address it anyway. The problem was not over-stimulation per se, although it did show that maybe more things could have been done, the real problem is after seeing the beginning of the collapse that the Government (Fiscal, Monetary policies) look for ways to let the economy change in a more gradual way. Sudden shocks whether deserved or not is of little consequence when unemployment is 25%.

7. "The sudden rise of global protectionism leading to the collapse of world trade." I don't have time to explain all the vast benefits of free trade here. But even if Jason was correct that as percentage of our GDP went from 6% to 2% percent, which can have drastic effects on an economy in the short run. Since over the long run exports(X)=(I)mports, this could mean a reduction in employment of industries that export of 4% of the total employment. In today’s terms it would mean 9% UE vs. the current 5%. That would be considered a major recession if not depression in today’s terms.

Also since trade was costly to transport and thus was not as much as today, then even if a small percentage of the economy, it would be of vital importance to the economy. Either products that can not be produced here with little substitutes or that had extraordinarily high cost to produce here.

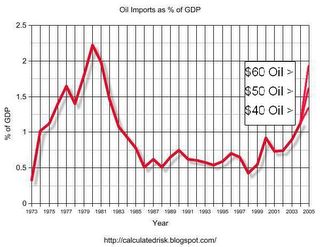

Even today oil imports are only over 1% of GDP (April 05). Oil Imports as % of GDP

But can anyone guess the problems we would have if the oil imports stopped completely without warning. Of course no one in the world wants this other than terrorists.

So I am sure that I missed some points, but hopefully it was of interest to you.

Links:

Index of Macroeconomic Topics

P.S.: Hank had brought up some interesting points.

One of the reasons for having active monetary and fiscal policies is to try and reduce destructive business cycles. One problem with Keynesian policies is that politicians only see that the cup is half full. They always like the fiscal stimulus but fail to use fiscal policy as a dampening effect on the economy. During the late 90's (blatant hindsight) Clinton and Congress should have raised taxes. Which taxes is a major consideration, but still important to consider the possible tax increases.

Luckily Monetary policy is more divorced from politics and as such you can see the Fed has been raising rates quit a bit to cool the possibility of inflation.

I would say that the New Deal had positive effects but was sharply reduced in 1937 to cause another recession. Of course the degree of improvement can never be determined since monetary policy had a lot of influence to get us out of the Great Depression also.

And no you are not off, Hank.

2 Comments:

Ronald

That is a good clear explanation.

As I understand it there is a ‘business cycle” the economy goes up and goes down. As you illustrated various government policies caused the “down” of the Great Depression to be a lot sharper and deeper than normal. Of no comfort to the people trapped in it the economy was going to go back up, how soon and how fast being the question.

The New Deal policies either sped up the process, slowed it down, or had no effect.

Thomas Sowall and others have made the argument that the policies of the Roosevelt administration, despite the popular opinion, actually slowed down the recovery. The argument seems rather overstated to me, I rather subjective impression is there was some net positive effect, but also the FDR fan clubs claims are rather inflated also.

I am completely off base?

Thank you for your complements.

I added a PS response.

Post a Comment

<< Home